Many hoteliers are wondering about the tourist tax 2026, its new pricing structures and their impact on billing. Between tourist taxrules specific to tourist accommodation and differences according to the local authoritiesRegulations evolve and each deliberation on tourist tax may change the amounts applied in hotels.

This guide contains everything you need to know: tourist tax scale, hotel tourist tax calculation, ceilings 2026 and update in Medialog PMS.

What exactly is the tourist tax?

First, let’s go back to basics.

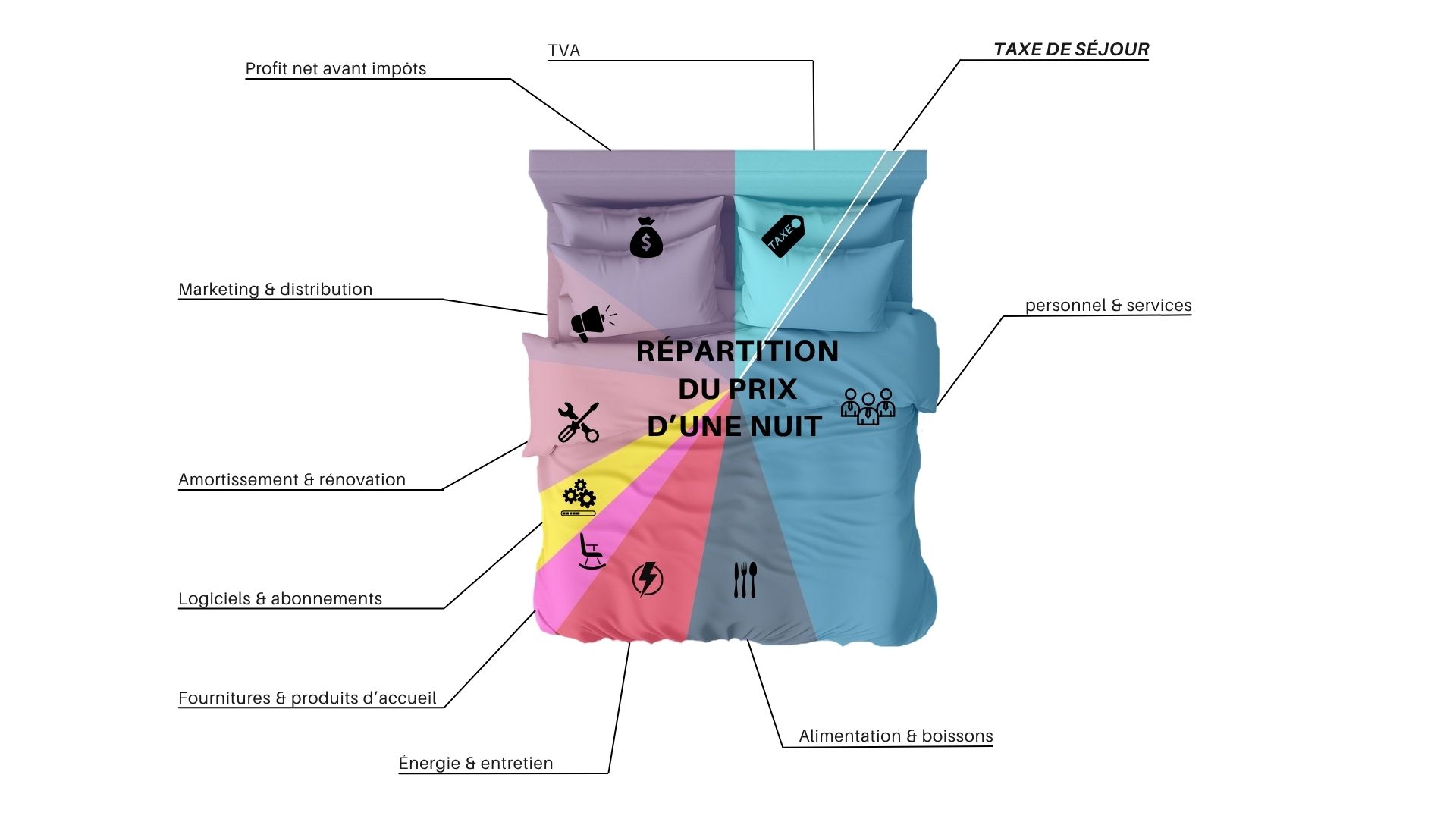

To quickly visualize where the cost of a hotel night goes from the traveler’s perspective, here is a graph that illustrates the cost allocationincluding the famous tourist tax (the one we’re interested in here 👇).

Of course, this distribution varies depending on the services offered by your establishment. Furthermore, as a hotelier, you do not keep the tourist tax: it is simply collected from the guest and then paid to the local authority. Therefore, it is not part of your income.

La tourist taxIt is a local contribution paid by the voyageurs, collected by the host (hotel, campsite, furnished accommodation, etc.) then paid to the local authority.

It is used to finance the local actions to promote tourism

infrastructure (roads, transport, cultural facilities…) and the sustainable development, destinations.

Some people are exempt (according to local decision):

● the Minors,

● the seasonal workers,

● or other special cases (emergency accommodation, temporary rehousing, etc.).

How does it work on the hotel side?

Who collects the collection and when?

The tax is usually collected at the time of payment for the overnight stay (upon arrival or departure, depending on your hotel’s procedures). It is always there. on the invoice, separate from the pre-tax price and VAT, and must be clearly identified below the line “Tourist tax”.

How is the tax calculated?

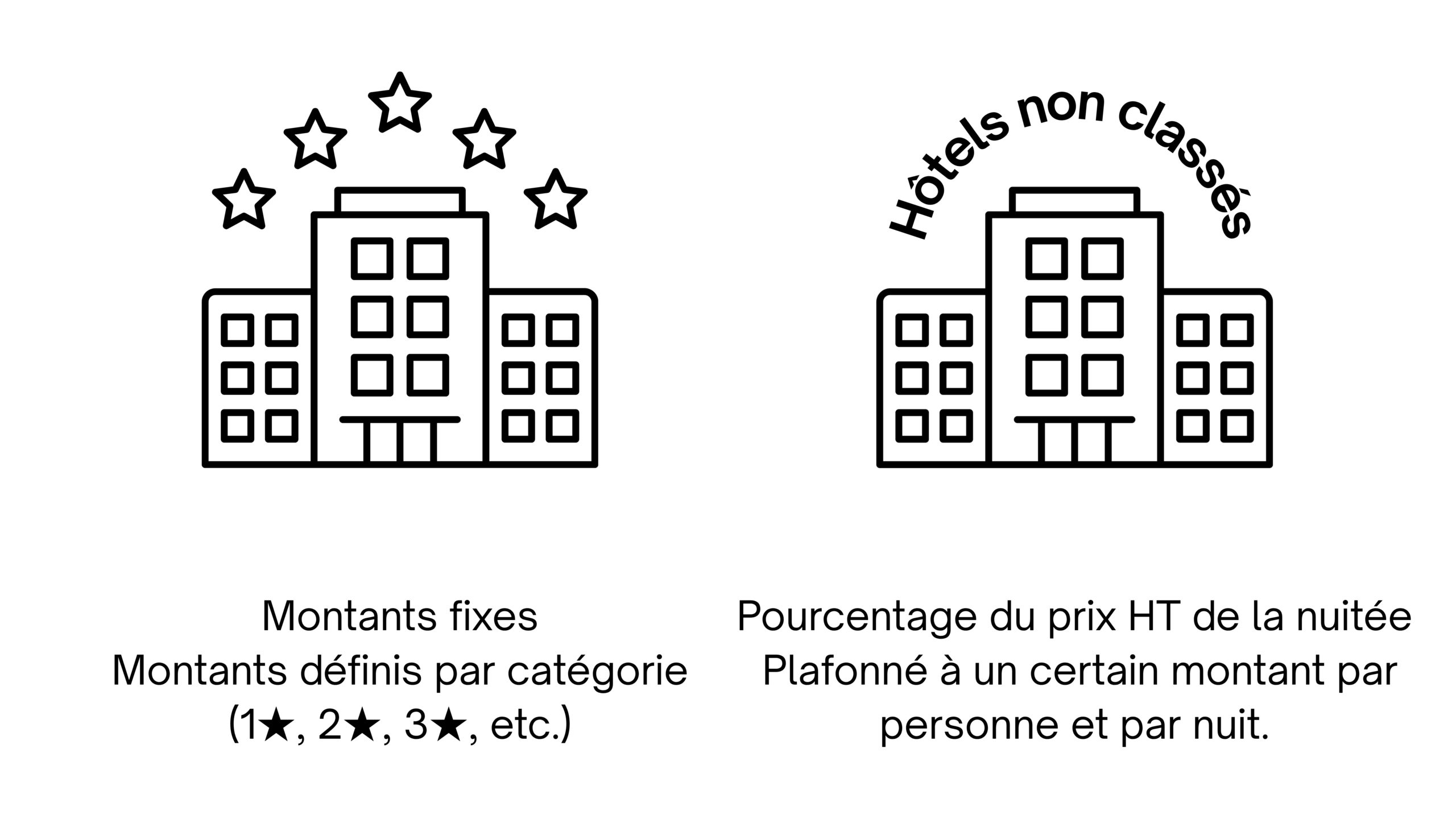

Two approaches exist depending on the classification of your establishment:

Each local authority vote his own scaleThis sometimes varies depending on the specific periods (low/high season), exemptions, and ceilings. If the overnight stay exceeds the ceiling, the applicable tax will be that ceiling.

Always consult la official deliberation of your municipality or inter-municipality.

Do you want to calculate the tax yourself if your establishment is unclassified? Here is the formula:

Tourist tax = (Rate % × Price excluding VAT per night), capped at €X/person/night

Note The pre-tax price of the nightly stay is divided by the total number of occupants, but the tax only applies to the number of people liable for the tax. For example, a minor is included in the calculation of the nightly rate but does not pay the tourist tax.

Declaration & Payment

Depending on your municipality, the declaration may be monthly ou quarterlyIt is done via the official website for online tax returns (Ex. taxedesejour.paris.fr, lyonmetropole.fr). of the late payment penalties penalties may apply if the declaration is not made on time.

You’re at reception and worried about forgetting something. Here’s a checklist to complete every month or quarter.

🧾 Reception checklist

● Display the tax on the customer invoice

● Record the number of adults subject to this requirement

● Track the filing dates

● Keep the exemption documents

What will change in 2026

Several local authorities have already published their new tourist tax rates for 2026. The table below lists those for which official information is available to date.

How to read this table:

1. Community

Indicates the municipality, inter-municipality or metropolis that sets the tourist tax rates.

2. Official Source

Link to the deliberation or the official page where the rates voted for 2026 are listed.

3. Columns “1 star” to “5 stars”

These are the fixed amounts of the tourist tax per person per night for each category of classified accommodation (1★ to 5★). These amounts include the tax set by the municipality as well as any additional percentages from the department and/or region. This is therefore the total amount.

4. Formula (unclassified)

Indicated the percentage applied to the pre-tax price of the night when accommodation is not unclassifiedThis percentage may vary depending on the local authority (3%, 4%, 5%, 5,5%, etc.).

5. Ceiling 2026 (unclassified)

Maximum amount that can be applied after calculating the formula (previous column). If the result exceeds this limit, a automatic markup is implemented by the community.

The column therefore indicates:

● the normal ceiling,

● the increased ceiling in case of exceeding.

Municipalities that have published their 2026 rates

| Community | Official Source | 1 star | 2 stars | 3 stars | 4 stars | 5 stars | Formula (unclassified) | Ceiling 2026 (unclassified) |

|---|---|---|---|---|---|---|---|---|

| Dijon Métropole (21) | Dijon Deliberation 2026 | € 0,66 | € 1,10 | € 1,87 | € 2,86 | € 3,96 | 5% of the pre-tax price per night, capped | €4,90 → €5,39 if exceeded (+10%) |

| Bayeux Intercom (14) | Bayeux Deliberation 2026 | € 0,73 | € 0,82 | € 1,36 | € 2,23 | € 2,82 | 5% of the pre-tax price per night | €4,32 (maximum amount applied) |

| Lyon Metropolitan Area (69) | Lyon Deliberation 2026 | € 0,88 | € 1,10 | € 1,87 | € 2,86 | € 3,96 | 5% of the pre-tax price per night, capped | €4,90 → €5,39 if exceeded (+10%) |

| Normandy Cabourg Pays d’Auge (14) | Normandy Deliberation 2026 | € 0,88 | € 1,10 | € 1,87 | € 2,86 | € 3,85 | 5% of the pre-tax price per night | €4,80 → €5,28 if exceeded (+10%) |

| Bordeaux Métropole (33) | Bordeaux Deliberation 2026 | € 0,80 | € 1,00 | € 1,70 | € 2,60 | € 3,60 | 5% of the pre-tax price per night, capped | €4,90 (no surcharge) |

| Vercors Massif (38) | Vercors Deliberation 2026 | € 0,83 | € 0,90 | € 1,10 | € 1,30 | € 2,00 | 3% of the pre-tax price per night | €2,73 → €3 if exceeded (+10%) |

| Alpe d’Huez (38) | Alpe d’Huez Deliberation 2026 | € 0,88 | € 1,10 | € 1,87 | € 2,86 | € 3,96 | 5,5% of the pre-tax price per night | €5,39 (maximum amount applied) |

| Font-Romeu (66) | Font-Romeu Deliberation 2026 | € 1,01 | € 1,01 | € 1,01 | € 1,01 | € 1,01 | 5% of the pre-tax price per night | €1,01 → €1,36 if exceeded (+44%) |

| Grand Lac (73) | Grand Lake Deliberation 2026 | € 0,77 | € 0,91 | € 1,14 | € 1,50 | € 3,14 | 5% of the pre-tax price per night, capped | €4,27 → €4,70 if exceeded (+10%) |

| Paris (75) | City of Paris – 2026 Rates | € 2,60 | € 3,25 | € 5,53 | € 8,45 | € 11,38 | 5% of the pre-tax cost + additional charges | €15,93 (maximum with 225% surcharge) |

| Rouen Normandy (76) | Rouen Deliberation 2026 | € 0,80 | € 1,00 | € 1,70 | € 2,60 | € 3,50 | 5% of the pre-tax price per night, capped | €4,90 → €5,39 if exceeded (+10%) |

| Grand Châtellerault – La Roche Posay (86) | Châtellerault Resolution 2026 | € 0,70 | € 0,73 | € 1,00 | € 1,20 | € 1,50 | 4% of the pre-tax price per night | €4,00 → €4,40 if exceeded (+10%) |

| Suresnes (92) | Suresnes Resolution 2026 | € 2,60 | € 3,25 | € 5,53 | € 8,45 | € 11,70 | 5% of the pre-tax price + additional shares | €4,80 → €15,60 if exceeded (+225%) |

| City and Eurometropolis of Strasbourg (67) | Strasbourg Deliberation 2026 | € 0,88 | € 1,10 | € 1,87 | € 2,86 | € 3,96 | 5% of the pre-tax price per night | €4,90 → €5,39 if exceeded (+10%) |

| CC Val d’Amboise and City of Amboise (37) | Amboise Deliberation 2026 | € 0,81 | € 0,92 | € 1,54 | € 2,55 | € 3,05 | 3% of the pre-tax price per night | €4,00 → €4,40 if exceeded (+10%) |

Last updated: November 2025.

📌 Important

If your municipality does not appear in the list, it means that the resolution had not yet been published at the time of writing this article, or that we were unable to find it.

If you have the resolution, you can send it to us at marketing@medialog.fr.

You can also search for it on Google by typing: “Tourist tax 2026 resolution [name of the municipality or inter-municipality]”.

How Medialog PMS comes into play

Municipalities publish their tourist tax rates for the coming year. With Medialog PMS, you can update your settings as soon as the new rates are available. The software supports you regardless of your establishment type, but the setup process isn’t exactly the same depending on whether you are a hotel or a restaurant. class ou unclassified.

For classified establishments: a fixed amount to be entered

If your hotel is classThe tourist tax corresponds to a fixed amount per adult per night, defined by local deliberation.

👉 See the step-by-step guide to adjusting the tourist tax – Classifieds

For establishments that are not classified or are awaiting classification: an automatic formula

If your hotel is unclassified ou pending classificationThe tourist tax is calculated as a percentage of the Price excluding VAT per person per night, With a ceiling which depends on your municipality.

👉 See the step-by-step guide to adjusting the tourist tax – Uncategorized

FAQ

● Who is exempt? Minors, seasonal workers, emergency accommodation (see service-public.fr).

● Does the tax apply to breakfasts? No, only on the accommodation portion.

● And what about OTAs? In general, the collection remains the responsibility of the hotelier, except in certain cases (e.g. Airbnb for some cities).

● Where can I find the pricing schedule for my local authority? On the local platform or via the national directory taxesejour.fr.

● What to do if a customer disputes? Show the local deliberation and the tax line on the PMS invoice.

Conclusion

La tourist tax 2026 It mainly brings technical adjustments: new ceilings, harmonizations and modernization of local declarations.

🧾 In plain terms:

You collect, Medialog calculates, the community receives, and everyone sleeps soundly.